How I Started Late and Finished Rich: My Journey to Financial Freedom

As I reflect on my journey through the world of personal finance, one mantra has consistently resonated with me: “Start Late, Finish Rich.” This powerful phrase encapsulates a liberating truth that many of us often overlook—it’s never too late to take control of our financial destiny. Whether you’re in your thirties, forties, or even beyond, the potential to build wealth and secure a prosperous future is still within your grasp. In this article, I want to share insights and strategies that have helped countless individuals transform their financial lives, regardless of when they began their journey. Join me as we explore how embracing the concept of starting late can not only empower us but also lead us to remarkable financial success. Together, we’ll uncover the steps to defy conventional wisdom and craft a rich, fulfilling life on our own terms.

I Explored The Secrets Of Minimalist Living And Shared My Insights Below

Start Late, Finish Rich: A No-Fail Plan for Achieving Financial Freedom at Any Age

(Start Late, Finish Rich: A No-fail Plan for Achieving Financial Freedom at Any Age) By David Bach (Author) Paperback on (Jun , 2006)

1. Start Late, Finish Rich: A No-Fail Plan for Achieving Financial Freedom at Any Age

As I delve into the transformative insights offered in “Start Late, Finish Rich A No-Fail Plan for Achieving Financial Freedom at Any Age,” I find myself increasingly inspired by the core message of this book. The title itself speaks volumes to those of us who may feel that time is not on our side when it comes to financial planning. It reassures us that it’s never too late to take charge of our financial future and achieve the wealth we desire.

The author, David Bach, presents a compelling argument that age should not be a barrier to financial success. Instead, he emphasizes that with the right mindset and a structured approach, anyone can carve out a path to financial freedom, regardless of when they start. This is particularly reassuring for individuals who may have delayed their financial planning due to life circumstances, career changes, or simply feeling overwhelmed by the complexities of managing money.

What I appreciate most about Bach’s writing is the no-nonsense, practical advice he offers. He breaks down the seemingly daunting task of financial planning into manageable steps that anyone can follow. This is crucial for those of us who might be intimidated by finance jargon or complicated investment strategies. Bach’s approach is straightforward, making it easy for me to grasp and implement the strategies he outlines. His emphasis on actionable plans ensures that readers can see immediate results in their financial journey.

Moreover, the book is packed with relatable anecdotes and real-life examples that resonate with me. It’s refreshing to read about others who have faced similar challenges and successfully navigated their way to financial stability. This not only provides a sense of community but also instills confidence that I, too, can achieve my financial goals. Bach’s relatable storytelling makes the journey feel less isolating and more achievable.

Another standout feature of this book is its focus on building a wealth mindset. Bach encourages readers to visualize their financial goals and cultivate a positive relationship with money. This psychological aspect of financial planning is often overlooked, yet it is incredibly powerful. By changing the way I think about money and wealth, I am more likely to attract opportunities that align with my financial aspirations. This mindset shift can be a game changer, especially for those of us who have struggled with negative beliefs surrounding money.

In terms of practical features, “Start Late, Finish Rich” offers actionable tips, worksheets, and resources that empower me to take control of my finances. For instance, the book guides readers through budgeting techniques, investment strategies, and retirement planning—areas that can often feel overwhelming. By providing clear, step-by-step instructions, Bach makes it possible for me to create a personalized financial plan that fits my unique situation.

Ultimately, I believe this book is an invaluable resource for anyone looking to improve their financial situation. Whether I am in my 30s, 40s, or beyond, the principles outlined in “Start Late, Finish Rich” can be applied to my life. It’s a reminder that financial freedom is not just for the young or the wealthy; it’s attainable for anyone willing to put in the effort.

I highly recommend “Start Late, Finish Rich” to anyone who feels that time has slipped away in terms of financial planning. With its clear guidance, motivational insights, and practical tools, this book serves as a beacon of hope for those of us ready to reclaim our financial future. So why wait? Dive into the pages of this book and take the first step toward the financial freedom you deserve.

Feature Description Actionable Advice Provides clear steps to implement financial planning strategies. Mindset Shift Encourages a positive relationship with money and visualization of goals. Relatable Stories Includes real-life examples that resonate with readers. Practical Tools Offers worksheets and resources for budgeting and investment. Accessible for All Ages Emphasizes that financial freedom is possible at any stage of life.

Get It From Amazon Now: Check Price on Amazon & FREE Returns

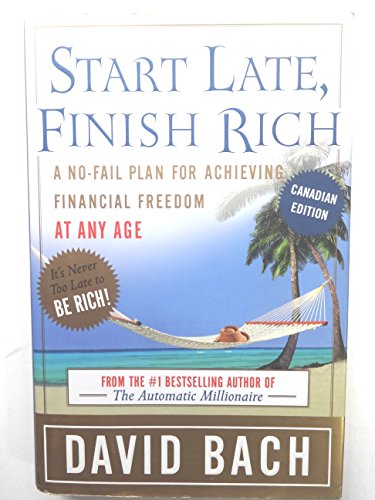

2. Start Late, Finish Rich, Canadian Edition

As I dive into the world of personal finance literature, I find that “Start Late, Finish Rich, Canadian Edition” by David Bach stands out as a compelling resource for anyone looking to take control of their financial future, especially those who may feel they are starting their financial journey a bit later in life. This book is not just about making money; it’s about transforming your mindset around wealth and giving you the tools to achieve financial independence, regardless of where you are starting from.

One of the most appealing aspects of this book is its accessibility. David Bach has a unique ability to break down complex financial concepts into simple, actionable steps. He understands that many readers may feel overwhelmed by the idea of investing or saving, especially if they’ve felt they missed the boat in their earlier years. The Canadian Edition specifically tailors its advice to the Canadian financial landscape, which makes it particularly relevant for readers in Canada. This localized approach means that the strategies and recommendations are directly applicable to my financial situation, whether it’s regarding retirement savings plans (RSPs), tax-free savings accounts (TFSAs), or understanding the nuances of Canadian real estate investment.

What I appreciate most about “Start Late, Finish Rich” is Bach’s focus on the psychological aspect of wealth-building. He emphasizes that the journey to financial success is as much about mindset as it is about numbers. This resonates with me deeply, as it reminds me that overcoming limiting beliefs and developing a positive attitude towards money can lead to significant changes in my financial situation. The book encourages readers to visualize their financial goals and take consistent steps towards them, which I find incredibly motivating. It’s not just a guide; it’s a call to action that can inspire individuals to make the necessary changes in their lives.

Moreover, Bach provides practical advice that I can start implementing immediately. He offers a straightforward plan to tackle debt, save for retirement, and invest wisely. The “Latte Factor,” a concept he popularizes, illustrates how small daily expenses can add up over time and how cutting back on these can lead to substantial savings. This idea is a game-changer for someone like me, who might be tempted to dismiss minor expenses but is now encouraged to reconsider how these choices impact my financial future. By adopting his strategies, I can see a pathway to not just surviving but thriving financially.

In addition to the practical tips, the book is filled with real-life success stories that serve as encouragement. Hearing about others who have turned their financial lives around is not just inspiring; it’s proof that it is never too late to make a change. This sense of community and shared experience can be comforting for anyone who feels alone in their financial struggles. It reassures me that others have faced similar challenges and have emerged victorious, reinforcing the idea that I too can achieve my financial dreams.

“Start Late, Finish Rich, Canadian Edition” is more than just a financial guide; it’s a motivational tool that empowers readers to take charge of their financial destinies. Whether I’m looking to pay off debt, save for retirement, or simply gain a better understanding of my finances, this book offers the insights and strategies I need to make informed decisions. I genuinely believe that anyone, regardless of their financial starting point, can benefit from the lessons in this book. If you’re contemplating whether to invest in your financial education, I encourage you to consider adding this title to your reading list. It could very well be the turning point in your journey towards financial freedom.

Feature Description Localized Content Tailored advice for the Canadian financial landscape, including RSPs and TFSAs. Accessible Language Complex financial concepts simplified into actionable steps. Mindset Focus Emphasizes the psychological aspect of wealth-building and overcoming limiting beliefs. Practical Strategies Immediate advice on debt reduction, saving, and investing. Real-Life Success Stories Inspiring examples of individuals who have transformed their financial situations.

Get It From Amazon Now: Check Price on Amazon & FREE Returns

3. (Start Late, Finish Rich: A No-fail Plan for Achieving Financial Freedom at Any Age) By David Bach (Author) Paperback on (Jun , 2006)

When I came across the book titled “Start Late, Finish Rich A No-fail Plan for Achieving Financial Freedom at Any Age” by David Bach, I couldn’t help but feel a sense of excitement. The title itself is incredibly motivating, especially for those of us who may think that we’ve missed the boat on achieving financial success. The premise of the book is simple yet powerful it’s never too late to start working towards financial freedom. This message resonates with anyone, regardless of age, background, or previous financial decisions. It encourages readers to take control of their financial futures, which is a liberating thought.

One of the key features of this book is its accessibility. David Bach writes in a way that is easy to understand, breaking down complex financial concepts into digestible pieces. This is particularly important for those who may not have a strong background in finance. The book is filled with practical advice that readers can implement immediately, making it a valuable resource for anyone looking to improve their financial situation. I appreciate how Bach emphasizes actionable steps rather than overwhelming jargon, making it approachable for everyone.

Furthermore, the book offers a comprehensive plan that addresses various aspects of financial well-being. From saving strategies to investment tips, “Start Late, Finish Rich” covers it all. I find it particularly beneficial that Bach includes real-life examples and success stories, which serve as motivation and proof that his strategies work. This can be incredibly encouraging for readers who might feel disheartened by their current financial status. Knowing that others have successfully turned their situations around gives me hope and inspires me to take action.

Another remarkable feature of this book is its focus on mindset. Bach emphasizes the importance of changing how we think about money and wealth. He encourages readers to adopt a positive financial mindset, which I believe is crucial for anyone looking to achieve financial freedom. This aspect of the book speaks to me because it highlights that our thoughts and beliefs about money can significantly impact our financial reality. By shifting my mindset, I can create a more abundant and successful financial future.

In addition to the motivating content, the book is structured in a way that makes it easy to navigate. I appreciate how Bach organizes his ideas into clear sections, allowing readers to focus on specific areas that they may want to improve. This makes it simple to refer back to particular topics as needed. The practical exercises and worksheets included in the book provide a hands-on approach, making it easier to implement the strategies discussed. I find that this interactive element enhances my understanding and commitment to the financial plans laid out in the book.

Overall, I genuinely believe that “Start Late, Finish Rich” is an invaluable resource for anyone seeking financial freedom, especially those who may feel it’s too late for them. David Bach’s no-fail plan is not just a promise; it’s a realistic approach that empowers individuals to take charge of their finances. If you’re looking for a guide that combines motivation with practical advice, I highly recommend picking up this book. It could very well be the turning point in your financial journey. Don’t let the fear of starting late hold you back—embrace the opportunity to finish rich!

Feature Description Accessibility Easy-to-understand language that breaks down complex financial concepts. Comprehensive Financial Plan Covers saving strategies, investment tips, and real-life examples. Mindset Focus Encourages a positive financial mindset to influence financial reality. Structured Organization Clear sections that allow for easy navigation and reference. Interactive Elements Includes practical exercises and worksheets for hands-on learning.

Get It From Amazon Now: Check Price on Amazon & FREE Returns

4. Smart Women Finish Rich, Expanded and Updated

As someone who is always on the lookout for resources that empower women in their financial journey, I was thrilled to come across “Smart Women Finish Rich, Expanded and Updated.” This book has been a staple in the realm of personal finance for women and provides an approachable yet comprehensive guide to achieving financial independence. The title itself is incredibly inviting, suggesting that the path to financial success isn’t just for the privileged few but is attainable for all women.

One of the standout features of this book is its focus on the unique financial challenges women face. It dives into the societal and economic factors that have historically put women at a disadvantage. I appreciate how the author, David Bach, tailors his advice to resonate with women, making it relatable and practical. He emphasizes the importance of not just earning money but also understanding how to manage it effectively. This perspective is essential for women who may find themselves juggling multiple roles, from career demands to family responsibilities.

Another significant aspect of “Smart Women Finish Rich” is its actionable advice. The book is filled with practical steps that I can implement right away. Whether it’s creating a budget, understanding investments, or planning for retirement, Bach breaks down complex financial concepts into digestible segments. This makes the information not only accessible but also empowering. I felt a sense of ownership over my financial future as I read through the strategies laid out in the book.

Moreover, the expanded and updated edition means that the information is current and relevant to today’s economic landscape. Financial markets are always evolving, and having a resource that reflects the latest trends is invaluable. I appreciate that Bach has taken the time to update his insights, ensuring that I am equipped with the best knowledge to make informed financial decisions.

For women who might be apprehensive about engaging with financial topics, this book serves as an excellent starting point. It nurtures a mindset of confidence and encourages readers to take charge of their finances. The tone is uplifting and motivating, which can be incredibly beneficial for those who may feel intimidated by financial discussions. I found myself inspired to take the next steps toward financial literacy and independence.

In summary, “Smart Women Finish Rich, Expanded and Updated” is not just a book; it’s a financial toolkit designed for women. It empowers us to take control of our financial futures with confidence and knowledge. If you’re a woman seeking to enhance your financial literacy and gain the tools necessary for wealth building, I highly recommend adding this book to your collection. It could very well be the catalyst that transforms your financial journey.

Feature Description Targeted Financial Advice Focuses on the unique challenges women face in financial planning. Actionable Steps Provides clear, practical steps for budgeting, investing, and retirement planning. Current Insights Includes updated information relevant to today’s economic landscape. Empowering Tone Encourages confidence and ownership of personal finances. Comprehensive Toolkit A holistic approach to financial education designed specifically for women.

Get It From Amazon Now: Check Price on Amazon & FREE Returns

How “Start Late, Finish Rich” Can Help You Achieve Financial Success

I stumbled upon “Start Late, Finish Rich” during a time when I felt overwhelmed by my financial situation. The book resonated with me because it acknowledges that life can throw unexpected challenges our way, often delaying our financial goals. What I found most empowering was the author’s approach to financial planning; he offers a blueprint that is not only accessible but also tailored for those who feel they’ve missed the boat on wealth accumulation.

One of the key takeaways for me was the concept of mindset. The author emphasizes that it’s never too late to start working toward financial freedom. This perspective shifted my focus from regret about past decisions to taking actionable steps in the present. I learned to set realistic goals, create a budget, and develop a savings plan that fit my lifestyle. This shift in mindset made me feel more in control of my financial future.

Moreover, the book provides practical strategies that I could implement immediately. From investing in my skills to understanding the importance of passive income, each chapter equipped me with tools I could use to build wealth over time. I started to see that even small changes could lead to significant financial progress. Overall, “Start Late, Finish Rich” has not only inspired me but has also

Buying Guide for ‘Start Late, Finish Rich’

Understanding the Book’s Philosophy

When I first picked up ‘Start Late, Finish Rich’, I was intrigued by the idea that it’s never too late to achieve financial success. The book emphasizes that regardless of when you begin your journey toward wealth, you can still build a secure and prosperous future. This philosophy resonated with me as I realized that many people feel discouraged if they start planning for retirement later in life.

Assessing Your Current Financial Situation

Before diving into the book, I took a good, hard look at my financial status. I found it essential to understand where I stood in terms of income, expenses, debts, and savings. This self-assessment helped me identify areas where I needed improvement and set realistic goals for my financial future.

Setting Realistic Goals

One of the key takeaways from the book is the importance of setting achievable financial goals. I learned to break down my long-term aspirations into smaller, manageable steps. Whether it was saving for retirement, purchasing a home, or investing in my education, having clear goals kept me motivated and focused.

Developing a Financial Plan

After reading ‘Start Late, Finish Rich’, I was inspired to create a financial plan. The book provides valuable insights into budgeting, saving, and investing. I realized that having a structured plan is crucial for tracking progress and making adjustments as needed. This plan became my roadmap toward financial independence.

Embracing a Positive Mindset

The book emphasizes the power of a positive mindset in achieving financial success. I found that changing my perspective on money and wealth made a significant difference in my journey. I started viewing financial challenges as opportunities for growth rather than obstacles. This shift in mindset empowered me to take proactive steps toward my goals.

Learning About Investments

Investing was one area where I felt I needed more knowledge. ‘Start Late, Finish Rich’ introduced me to various investment options and strategies. I began to understand the importance of diversifying my portfolio and taking calculated risks. This knowledge has been instrumental in growing my wealth over time.

Building Multiple Income Streams

The idea of creating multiple income streams resonated with me deeply. I learned that relying solely on a single source of income can be risky, especially as I age. The book encouraged me to explore side hustles, passive income opportunities, and investments that could supplement my primary income. This approach has helped me increase my overall financial security.

Staying Committed and Consistent

One of the most important lessons I took from ‘Start Late, Finish Rich’ is the value of commitment and consistency. I realized that building wealth is a marathon, not a sprint. Staying dedicated to my financial plan, even when progress felt slow, has been essential. Regularly reviewing my goals and adjusting my strategies keeps me on track.

: My Financial Journey

‘Start Late, Finish Rich’ has been a transformative read for me. It’s not just about financial tips; it’s about mindset, resilience, and the belief that it’s never too late to change my financial destiny. As I continue my journey, I carry the lessons from this book with me, always striving for a richer future.

Author Profile

-

Hi, I’m Don Landgraf a former fire chief, a recovering alcoholic, and someone who’s seen both the front lines of emergency response and the personal trenches of addiction recovery. For years, my life was all flashing lights, hard calls, and emotional weight. But it was my own battle with alcoholism that truly reshaped my path.

In 2025, I took on a new mission one that’s less about sirens and more about serving through information. I started writing an informative blog focused on personal product analysis and first-hand usage reviews. The goal? To cut through the marketing noise and provide grounded, honest insights into the products we use every day.

Latest entries

- April 15, 2025Personal RecommendationsWhy I Switched to Round Fire Pit Grates: A Game-Changer for My Backyard Experience

- April 15, 2025Personal RecommendationsUnboxing My Snoop On The Stoop Funko: A Funko Collector’s Dream Come True!

- April 15, 2025Personal RecommendationsWhy I Swear by Round Hat Boxes with Lids: My Top Tips for Stylish Organization

- April 15, 2025Personal RecommendationsWhy I Trust the Motorola Talkabout T460 Two Way Radios for Reliable Communication: My Expert Review